AMM meaning

Last updated 1 month agoWhat Is An Automated Market Maker (AMM)? Definition & Features

What does AMM stand for?

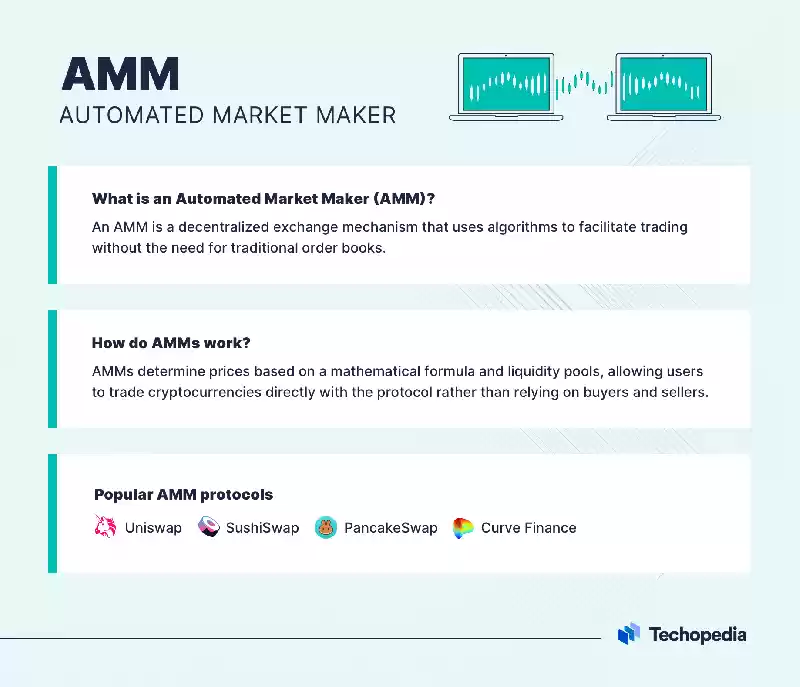

An automatic market Maker (AMM) is a decentralized alternate (DEX) that makes use of Smart Contracts to facilitate trades.

To apprehend the defiNition of the automatic market maker and the way it works, we first should learn the way centralized excHanges (CEX) Function. When you trade cryptocurrencies on a CEX, the trade suits your purchase/sell orders with another trader’s sell/buy orders. The CEX may additionally act as a Liquidity Provider (LP) to make sure the trades are facilitated easily and effectively. Here, the CEX is the market maker, and the Procedure is referred to as order book Advertising making.

In Decentralized Finance (DeFi), the trading of property occurs without middleman matching orders and offering Liquidity. This is where AMMs are available.

Traders Switch Tokens directly with one another via smart contracts. The liquidity in a DEX may be furnished with the aid of all and sundry. Liquidity Carriers are incentivized to contribute their cryptocurrencies into liquidity swimming pools. LPs are rewarded with a percentage of the trading fees.

AMMs have eMerged as Groundbreaking innovations that would probably disrupt how inventory exchanges operate. By the usage of AMMs, we will now trade belongings Peer-To-Peer (P2P) with out an middleman.

AMM Explained: DEX vs CEX

Below are the principle variations between AMMs used on DEXs and order books used on CEXs.

How Do Automated Market Makers Work?

There are three Exceptional ways how an AMM works.

1. Constant Product Market Maker Model (CPMM)

CPMM is the maximum popular AMM model, that's primarily based on the mathematical Components x*y=ok.

In the Method, X is the balance of token A, and Y is the stability of token B in an A-B liquidity pool. The Formulation States that the product K ought to now not change.

For example, in an ETH-UNI pool, each time a dealer buys ETH in trade for UNI, the price of ETH will move up barely as there can be less ETH left in the pool. Meanwhile, the rate of UNI will go down barely, ensuring that product K is regular. The ETH-UNI pool will hold a Constant stability as the cost of ETH will usually be equal to the fee of UNI in the pool.

Arbitrageurs are incentivized to step in if the Charge of ETH-UNI in an AMM actions away from prices on different exchanges.

2. Constant Sum Market Model (CSMM)

CSMM is based totally at the mathematical method x y=okay. This model is understood for facilitating zero-slippage trades however it does now not allow countless liquidity. The CSMM version is vulnerable to arbitrageurs draining one of the reserves if there are fee discrepancies.

The CSMM model is not often used.

3. Constant Mean Market Maker (CMMM)

CMMM turned into brought by Balancer. This model allows liquidity swimming pools of extra than belongings and lets in asset Weights to be outside the 1:1 ratio.

An Example of How AMMs Work: Uniswap

Let’s see how buying and selling occurs on a popular Multi-Chain AMM – Uniswap.

- You want to buy a Stablecoin DAI. You have ETH on your pockets.

- You enter the aMount of ETH you need to switch for DAI within the ‘Swap’ Interface on Uniswap.

- Uniswap will automatically display the amount of DAI you may acquire on your ETH.

- Uniswap will suggest the quantity of gasoline prices needed to facilitate the trade. It will also imply the slippage percent, minimum Output, and expected output from the alternate.

- Once you sign up the change, the AMM will suit your buy order with a sell order inside the marketplace.

You can also grow to be an LP on Uniswap:

- As an LP, you'll must deploy your tokens in pairs. On Uniswap, you'll locate liquidity pools of any ERC-20 token pair. You also can create your very own pool of ERC-20 tokens in case you don’t locate the token pair.

- You can assessment the fee you'll earn on a given pair. There are three rate degrees on Uniswap. LPs earn zero.05% on sTablecoin-stablecoin pairs, 0.Three% on popular token pairs, and 1% on exceptional pairs.

- Let’s say you need to supply liquidity to the ETH-DAI liquidity pool. You will have to deposit equal U.S. Greenback values of ETH and DAI.

- Uniswap v3 also lets in LP to select a fee Variety for his or her token pair.

Disadvantages of AMM Models

Impermanent Loss

Impermanent loss refers to the loss in the market fee of tokens deposited in a liquidity pool versus preserving them in a pockets.

Impermanent loss can arise whilst the fee of tokens in a pair diverges from each other i.E. While the price of a token will increase/decreases at a quicker fee than the opposite.

The loss is referred to as impermanent due to the fact the LP will most effective recognize the loss once they withdraw their tokens from the pool.

Inefficient markets

Providing liquidity to an AMM doesn’t usually bring about creating a earnings. If there isn't sufficient liquidity in swimming pools, exchange Volumes on AMMs can be low, ensuing in meager trading prices earned.

Low liquidity also can cause better slippage, specifically in massive-order trades.

The Bottom Line

AMMs have transformed how we trade cryptocurrencies. With time, this version has the potential to go into the traditional finance global.

There are change-offs in terms of AMMs, as Decentralization is prioritized over capital efficiencies. The accurate information is that AMMs are nevertheless develoPing and are simplest going to turn out to be extra efficient with technical Enhancements and wider participation from the hundreds.

Your Score to Automated Market Maker (AMM) article

Score: 5 out of 5 (1 voters)

Be the first to comment on the Automated Market Maker (AMM)