What is a Flash Loan? Definition, How It Works, Pros & Cons

A flash loan is a Form of loan in the Decentralized Finance (DeFi) ecosySTEM that lets in customers to borrow property while not having to offer collateral or a credit score. This type of loan has to be paid lower back inside the equal Blockchain Transaction bLock.

The entire system of borrowing, repaying, and masking flash loan costs can take as little as 15 seconds.

What is a Flash Loan?

Flash loans are a popular way for Cryptocurrency day buyers to take advantage of Swiftly converting markets. Within the DeFi ecosystem, flash loans are used for arbitrage, liquidations, and collateral swaps.

- Arbitrage. The borrower purchases crypto property at a decrease Charge on one market and sells them at a better rate on some other market.

- Liquidations. The borrower uses the mortgage to control a specific cryptocurrency market of their prefer.

- Collateral swaps. The borrower uses the mortgage to shut an existing mortgage earlier than straight away taking away a brand new mortgage with higher phrases.

The concept of “flash loans” is regularly credited to Max Wolff, creator of the Marble Protocol.

Flash loans are applied with Smart Contracts on blockchain Networks like Ethereum and are included with a lending protocol or DeFi Platform, which includes Aave or dYdX.

How Flash Loans Work

To follow for a mortgage, the borrower creates a smart agreement that carries a thing for borrowing, a element for interacting with different clever contracts, and a Component for returning the loan upon Final touch.

Borrowing factor: This a part of the smart contract iNitiates the flash mortgage and specifies the aMount to be borrowed from the lending protocol. A lending protocol is a decentralized, blockchain-based platform that allows users to lend and borrow virtual property without the want for a bank’s approval.

Interaction aspect: This a part of the clever agreement consists of the good judgment for interacting with other smart contracts and DeFi systems.

Repayment thing: This a part of the smart contract is answerable for returning the borrowed budget (plus a small transaction rate) to the lending protocol within the identical transaction. The compensation has to arise before the transaction is completed, or the complete transaction may be rolled again.

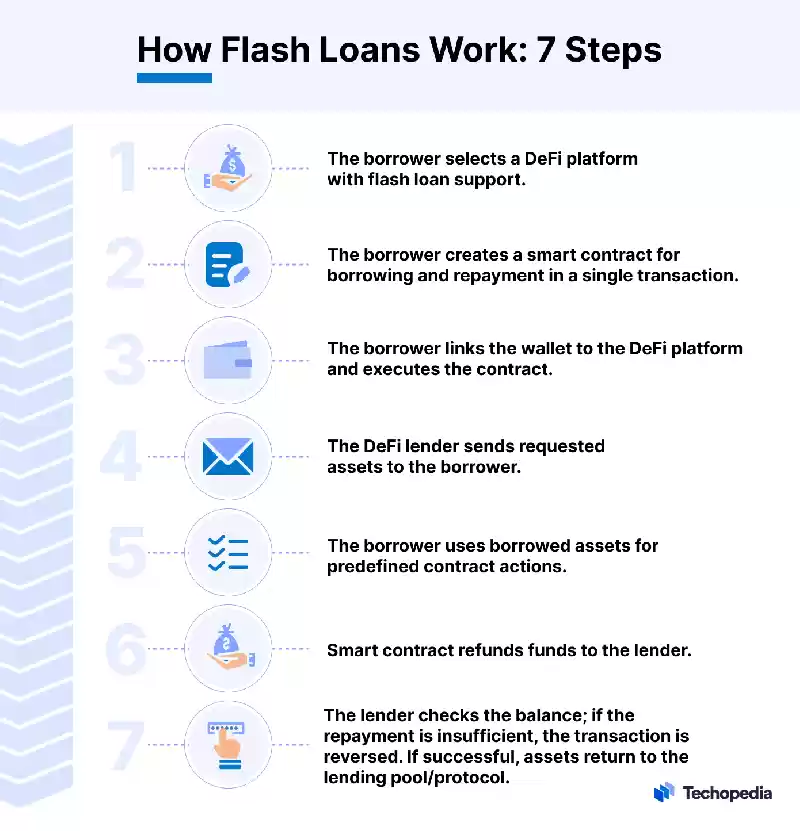

The borrowing Method itself includes seven steps:

- The borrower chooses a DeFi platform that supports flash loans.

- The borrower creates a clever contract that carries the good judgment for borrowing, interacting with other clever contracts, and repaying the mortgage inside the equal transaction.

- The borrower connects their wallet to the chosen DeFi platform and executes the clever contract.

- The DeFi lender transfers the asked belongings to the borrower.

- The borrower Makes use of the borrowed belongings to provoke predefined smart settlement operations.

- The clever settlement returns the borrowed finances to the lender.

- The lender verifies their stability. If the repaid amount is inadequate, the lender right now reverses the transaction. If the mortgage has been effectively repaid in the identical transaction, the borrowed assets are returned to the lending pool or protocol from which they have been borrowed.

Flash Loan Platforms

Popular DeFi platforms that allow flash loans include:

- Aave. A lending platform based on the Ethereum blockchain.

- Equalizer Finance: A Committed flash mortgage platform for markets on Ethereum, Binance Smart Chain, Polygon, and Optimism.

- Furucombo. A Multi-Chain DeFi aggregator designed to simplify, optimize, and automate DeFi buying and selling.

- Uniswap. A decentralized cHange (DEX) that allows customers to alternate Ethereum Tokens without the need for an account or prices.

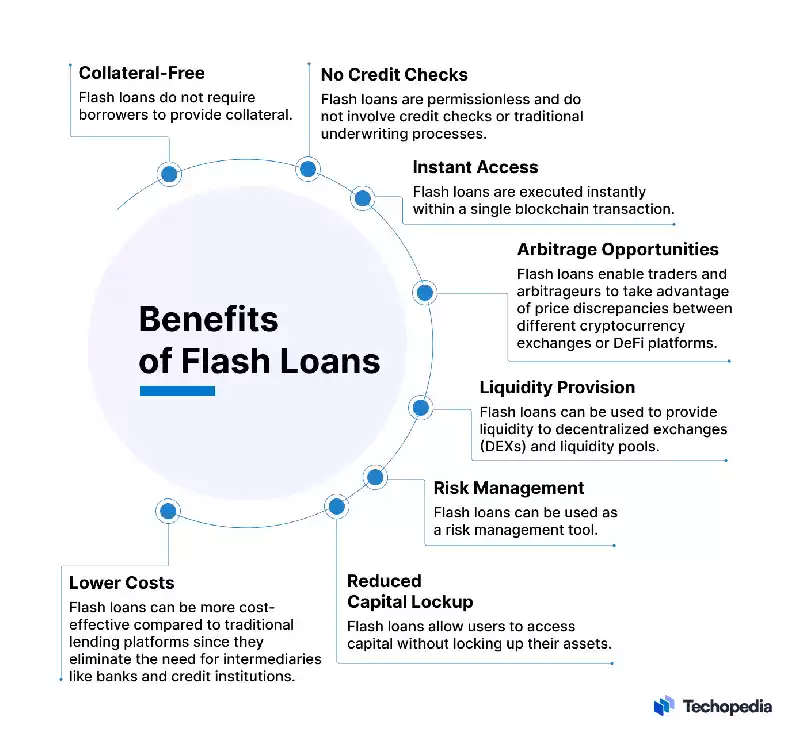

Benefits of Flash Loans

Flash loans have won recognition in the DeFi space because they allow debtors to take advantage of marketplace inefficiencies and quickly execute complex monetary operations without the overhead commonly related to conventional loan Packages.

Risks of Flash Loans

From the lender’s perspective, this type of loan is considered to be threat-Free, but there are nonetheless sure risks associated with the usage of them, including:

Smart settlement vulnerabilities: The protection of a flash mortgage relies upon at the correctness of the smart settlement Code. When there are insects or vulnerabilities within the loan’s clever settlement, it is able to lead to unintended results, consisting of a loss of funds.

Price slippage: When executing trades or swaps inside the Context of a flash mortgage, charge slippage can occur – especially when big quantities of liquid property are involved. This can bring about a higher-than-expected cost and make it tough for the borrower to repay the mortgage within the equal transaction.

Gas prices: Because flash loans contain multiple clever contract interactions in a single transaction, they can devour huge amounts of gasoline at the Ethereum network or different blockchains. If gas charges are excessive, the value of executing a transaction can outweigh ability earnings.

Market dangers: Flash mortgage techniques regularly involve marketplace-based actions consisting of arbitrage or liquidation. Rapid Modifications in market situations, fee volatility, or Liquidity can impact the success of those techniques and lead to transaction Failures or losses.

Compliance dangers: Flash mortgage transactions that result in the Exploitation of vulnerabilities, arbitrage, or other movements that negatively effect different market contributors may want to potentially expose users to prison legal responsibility.

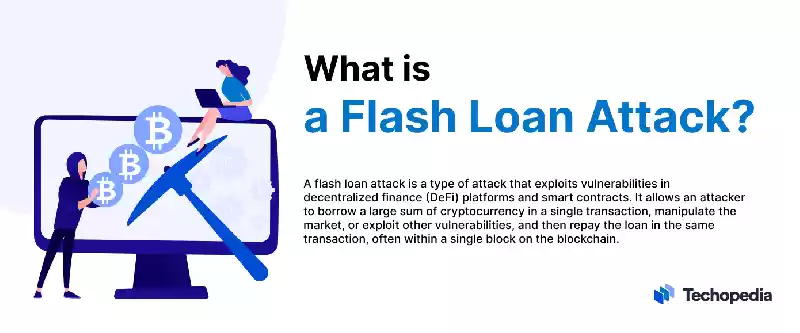

Flash Loan Attacks

According to the FBI, clever contracts have become one in every of the most important Attack Vectors in DeFi.

Detecting and prEventing attacks on DeFi protocols and smart agreement code may be difficult due to the fact this sort of attack takes place in no time. Here are some examples of a hit assaults:

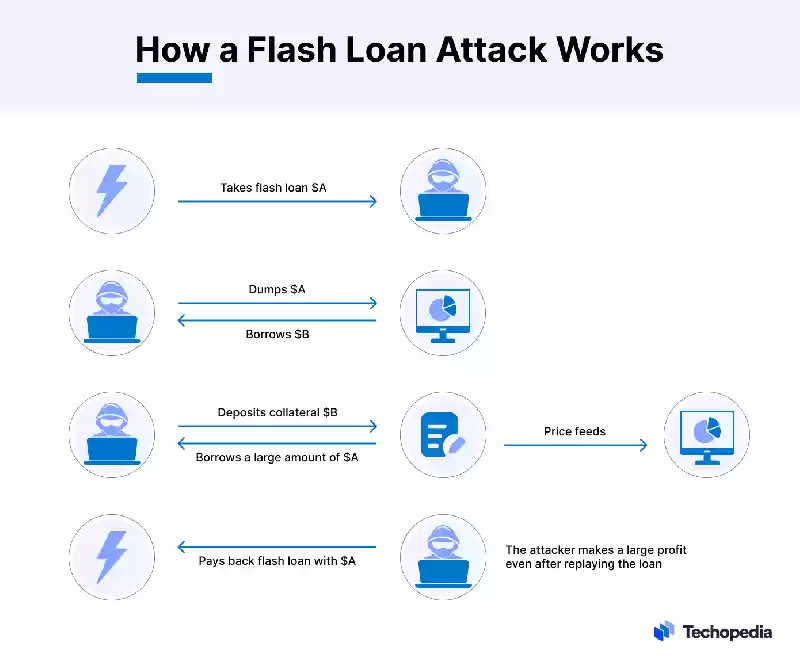

- In October 2020, an attacker used a flash mortgage to make the most a Vulnerability inside the Harvest Finance protocol and made a income of about $24 million.

- In May 2021, an attacker used a flash loan to govern the rate of Binance Smart Chain’s native token (BNB) and take advantage of the PancakeBunny protocol. By borrowing a huge quantity of BNB and swapPing it with other tokens, the attacker created a giant price imbalance. They then dumped the tokens in the marketplace, causing the rate to plummet by way of over ninety five%.

- In April 2022, an attacker used a flash loan to attain a huge quantity of Beanstalk STALK tokens, which then gave them sufficient voting power to bypass a governance thought that tired all the funds at the protocol into the attacker’s pockets.

- In March 2023, the United Kingdom-primarily based De-Fi platform Business enterprise Euler misplaced a said $196 million to a flash loan assault. The attack turned into first observed through safety researchers at PeckShield, a blockchain protection and information Analytics firm.

To save you flash loan attacks, the FBI recommends rigorous trying out, actual-time tracking, and developing an incident reaction plan that includes alerting buyers when smart contract exploitation, vulnerabilities, or other suspicious activity is detected.

Decentralized pricing oracles like Chainklink or Band Protocol can also assist ensure the charge facts utilized by DeFi protocols is accurate and proof against manipulation.

Your Score to Flash Loan article

Score: 5 out of 5 (1 voters)

Be the first to comment on the Flash Loan