What is ROI? Definition, How to Calculate and Interpret, Limitations

Return on investment (ROI) is a ratio that measures the advantage or loss generated from an funding relative to its buy fee. It gives a clear and standardized way to assess the overall perFormance of various investments, making it less complicated to examine their viability and potential consequences.

ROI is a commonplace Metric in conventional finance (TradFi), as well as Cryptocurrency trading.

Whether you’re a seasoned investor, a commercial enterprise proprietor, or without a doubt trying to Make knowledgeable monetary decisions, information it is key.

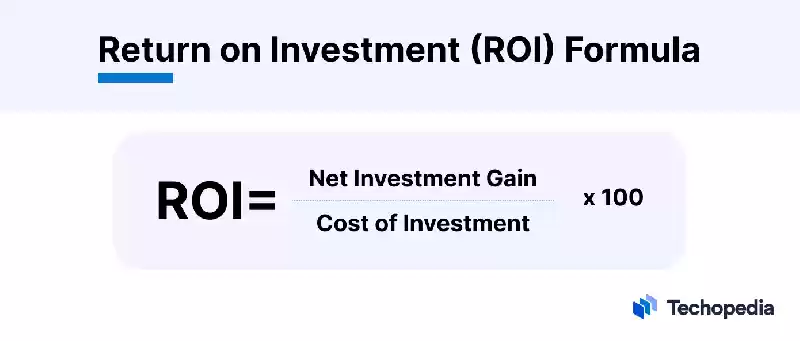

How to Calculate ROI

ROI is typically expressed as a ratio or percent. The formula for a percentage is:

- Net earnings – or Internet investment benefit – refers to the total advantage from the funding minus costs or costs. It is important to remember all costs, consisting of iNitial funding Charges, protection, and taxes.

- Cost of investment refers to the overall quantity invested within the undertaking or asset. This consists of the initial buy fee, as well as any additional capital invested through the years.

To take an example of ROI within the cryptocurrency market:

An investor buys 2 ETH at $1,500 each. The fee rises to $1,800. They have an ROI of 0.20 or 20% on their $3,000 investment.

Interpreting ROI

ROI is a distinctly honest metric to interpret:

Why is ROI SigNiFicant?

Understanding ROI is critical for several motives:

- Assessing investment opportunities. ROI enables buyers examine the capability returns of different funding alternatives. By evaLuating the ROI of numerous alternatives, buyers could make knowledgeable decisions approximately asset allocation.

- Measuring performance. ROI enables buyers gauge the capability achievement of an funding. A fantastic ROI points to a profitable funding, whereas a terrible ROI indicates a loss.

- Risk Management. ROI is a useful tool for assessing chance. Investments with a higher ability ROI commonly carry a better danger. Understanding the connection among danger and go back enables investors make choices that align with their financial goals.

- Performance Benchmarking. ROI enables traders benchmark the performance of an investment in opposition to enterprise requirements or competitors to Discover areas for development of their portfolios.

Limitations of the Metric

Investors must keep in mind that ROI has a few barriers as a metric.

When evaluating investments, one may additionally appear like Greater worthwhile, but it would be less efficient if it takes a longer time period to generate the return. For example, if a crypto trade took 365 days to attain a 60% ROI, it would be much less efficient than a trade that took 7 months to attain a 50% ROI.

One strategy to that is to take into account annualized ROI to take the timescale into consideration.

The Bottom Line

Return on funding is a essential economic metric that allows traders compare and compare the capacity profitability of investments to pick out those with the best capacity returns.

Understanding ROI is prime to creating knowledgeable choices and maximizing investment income.

Your Score to Return on Investment (ROI) article

Score: 5 out of 5 (1 voters)

Be the first to comment on the Return on Investment (ROI)